WE SHARE OUR KNOWLEDGE

February 3 2025

Changes in Comarch ERP Optima 2025 – new features that will simplify process management

Comarch ERP Optima is one of the most commonly chosen solutions in Poland, dedicated to small and medium-sized businesses operating in various industries. The program supports sales, management, accounting, as well as HR and payroll services. It is already used by 60,000 companies, including 9,000 in the cloud version. Thanks to its specialized features, the system has gained significant popularity among accounting offices and tax advisors. The software is regularly updated to ensure compliance with applicable legal regulations.

Comarch ERP Optima, one of the most popular ERP solutions in Poland, introduces new features and improvements aimed at simplifying user tasks and enhancing the efficiency of business processes. The latest version of the system, 2025.2.1, includes changes that significantly impact sales processes, document management, and support for companies operating in specific industries.

Simplified sales processes thanks to the SME procedure

As of January 1, 2025, the special SME (Simplified Method for Export) procedure has been introduced to simplify the use of VAT exemption for small businesses operating within the European Union. This procedure allows the export of goods and services without the need to register VAT in each EU member state where the business operates. In the latest version of Comarch ERP Optima, a range of features have been added to support this procedure, enabling easy management of documents and intra-community transactions.

The introduction of the SME procedure comes with the need to meet certain conditions. For a business to benefit from the VAT exemption under this procedure, it must fulfill two main requirements:

- the total annual value of taxable supplies of goods and services within the EU (including Poland) must not exceed EUR 100,000 in the tax year.

- the business must meet the conditions set by each member state in which it intends to apply the VAT exemption, including exceeding the turnover threshold set by those states.

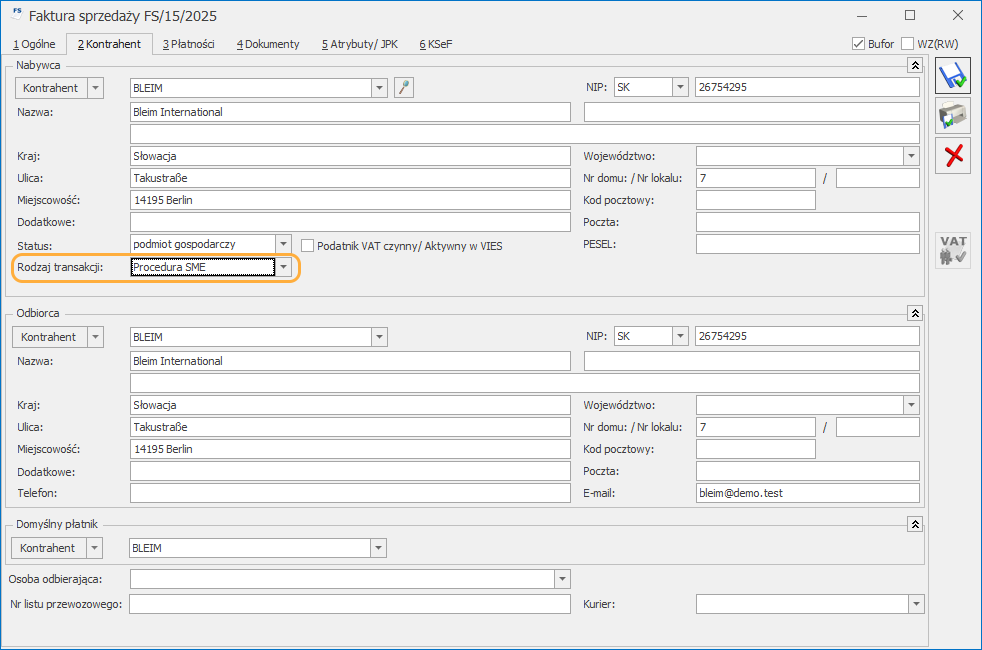

In Comarch ERP Optima, a new “Transaction type: SME Procedure” has been added. This enables the automatic assignment of the correct VAT rates to trade documents such as sales invoices and proforma invoices. Once the transaction type is set to “SME Procedure”, the VAT rates on the documents will automatically change to the ZW (exempt from VAT) rate, and the invoice prints will include the appropriate suffix – EX, indicating the application of the SME procedure.

Sample functionalities supporting SME:

- automatic change of transaction type – if a country where the entrepreneur applies the SME procedure has been added in the program’s configuration settings, and the contractor has the appropriate transaction type set (e.g., “Intra-community”), the system will automatically change the transaction type to SME Procedure and update the VAT rates to ZW.

- verification of buyer’s country – the system verifies the buyer’s country based on the prefix in the VAT number. If the buyer’s country is on the list of countries applying the SME procedure, the transaction type is automatically changed to SME Procedure.

- manual transaction change – the user has the option to manually change the transaction type to SME Procedure in trade documents such as sales invoices, proforma invoices, and other stock and trade documents (FPF, FZAL, FS, RO, ZD, PZ, FZ). It is necessary for the contractor to have the correct VAT number prefix indicating the country of origin.

- VAT exemption attributes –on sales invoices issued under the SME procedure, an attribute indicating the legal basis for VAT exemption (Article 113a, paragraph 1 of the VAT Act) is automatically added. This is important for legal compliance. This attribute is printed on sPrint-type documents.

- related documents – when converting trade and stock documents, such as RO, FPF, ZD, WZ, PZ, into other documents, the transaction type is carried over to the resulting documents. The system automatically adjusts the transaction type according to the appropriate settings, depending on whether the buyer’s country is on the list of countries where the user applies the SME procedure.

Changes in Accounting

The latest version of Comarch ERP Optima introduces significant changes in the accounting area aimed at streamlining the handling of tax declarations, VAT registers, and cash-based PIT records. New functionalities include, among others, the ability to submit declarations for the year 2024, support for the SME procedure, and integration with the e-Deklaracje system. Tax limits and public benefit organizations have also been updated. These improvements provide users with greater convenience and ensure compliance with current tax regulations.

- PIT and CIT Declarations: the system now supports sending annual PIT-37(30), CIT-10Z(6), and IFT-2/IFT-2R(11) declarations for 2024 to the e-Deklaracje system, with updated forms. Warnings have been added for CIT-10Z(6) and IFT-2/IFT-2R(11) declarations when selecting periods before 2024.

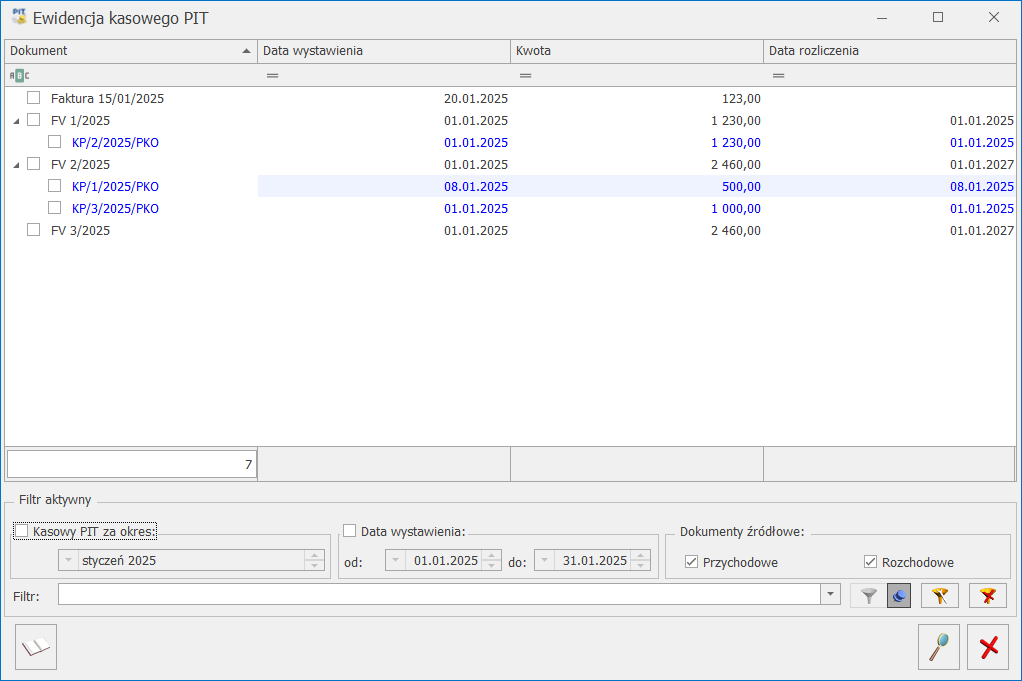

- Cash-based PIT: a new functionality has been introduced for posting settlements from the Cash PIT Records module. The system now allows posting to the tax ledger and lump-sum records. The posting process takes into account different settings for purchase and sales documents.

- Multi-company Operations: the system now allows sending CIT-10Z(6) and IFT-2/IFT-2R(11) declarations for 2024 to the e-Deklaracje system, as well as supporting sPrint prints for transfers to Tax Offices and Social Insurance Institutions (ZUS).

- Changes in JPK_V7: a new branch “Calculation of VAT correction for purchases” has been added, with the ability to generate an annual VAT correction in sPrint format.

- Tax Limits and Changes: limits have been updated (e.g., for full accounting) and new limits for health insurance deductions have been set for 2025.

- VAT Registers – VAT Status Verification: a serial VAT status verification based on data from the Ministry of Finance service has been introduced.

- Changes in Reports: several changes in reports have been implemented, such as including sales exempt from VAT at the ZW rate in the Limit – VAT Obligation report, as well as adding an option to select a period for the Payroll Amounts report. The name of the “Documents from Clients” report has been changed to “Documents Received from Clients.”

New indicators, declarations and adjustments to regulations

In Comarch ERP Optima, several parameters related to payroll and HR have been updated to reflect changes in regulations for 2025. These updates include changes to ZUS contributions, sickness benefits, and health insurance contributions for business owners. Additionally, payroll forms, tax declarations, and adjustments in vacation and holiday records have been updated. These modifications aim to simplify payroll processes, improve legal compliance, and enhance HR management efficiency.

Indicators for 2025

Key indicators related to salaries and ZUS contributions have been updated. Starting from January 1, 2025, the new annual ZUS contribution base is set at 260,190 PLN, along with new limits for declared income and voluntary sickness contributions. Furthermore, changes have been made to the adjustment of sickness benefits and unused vacation leave compensation. Minimum ZUS contribution bases have also been defined for seconded employees.

Health insurance contributions for owners

Health insurance contributions for business owners have been adjusted based on the form of taxation. Depending on the chosen taxation method, the minimum basis for health insurance contributions is calculated at 75% of the minimum wage, with the contribution amount varying according to the selected tax system.

Changes in forms and declarations

A new feature is the ability to submit IFT-1/1R(17) declarations for the year 2024 and PFRON (INF-D-P) declarations for the period starting July 2024 to the e-Deklaracje system. Payroll forms have also been adjusted to separately display the amount of tax advance and health insurance contributions. New fields have been added to indicate per diems deducted from the ZUS contribution base and reduce income by per diems.

Changes in vacation and holidays

In accordance with the provisions of the Labor Code, a new parameter has been introduced in the absence records to account for a reduction in the annual vacation limit due to employee absence due to force majeure. Additionally, Christmas Eve has been added to the list of holidays, which will affect the calculation of days off.

Thanks to these changes, the Comarch ERP Optima system becomes more flexible and compliant with current regulations, allowing users to benefit from greater precision and simplicity in handling HR and payroll processes. In particular, the system now accounts for the needs of businesses operating under different taxation systems, such as the progressive tax scale, flat-rate tax, or lump-sum tax, which significantly simplifies the settlement process for business owners.

Would you like to learn about the features of the Comarch ERP Optima system?

This is the perfect moment to explore the capabilities that this comprehensive software offers. Our systems are designed to simplify business management in various areas, from finance and accounting to HR and payroll.

To fully understand how Comarch ERP Optima can support your business growth, we encourage you to contact our experts. Our specialists are ready to provide advice, answer any questions, and demonstrate how the system can be tailored to your individual needs.

Call us at: 17 777 61 00

Email: biuro@sagitum.pl

Try the free demo, which will allow you to get hands-on experience with the system’s features and interface. This way, you’ll be able to assess for yourself how Comarch ERP Optima works in your company’s daily operations.